Table Of Content

- Introduction

- Section 1: Understanding Technical Analysis

- Subsection 1.1: Candlestick Patterns

- Subsection 1.2: Support and Resistance

- Subsection 1.3: Moving Averages

- Subsection 1.4: Momentum Indicators

- Section 2: Fundamental Analysis and its Role in Trading

- Section 3: The Psychology of Trading

- Subsection 3.1: Overcoming Fear and Greed

- Subsection 3.2: Trading with Discipline

- Subsection 3.3: Managing Risk

- Section 4: Staying Ahead of the Game

- Subsection 4.1: Latest Crypto News and Market Trends

- Subsection 4.2: Trading Platforms and Tools

- Conclusion

- FAQs

Introduction

In recent years, cryptocurrencies have become more popular than ever before, and as a result, there has been an increase in demand from traders who want to capitalize on the market. While trading cryptocurrencies can be profitable, it is also a high-risk endeavor. Technical analysis plays a critical role in trading cryptocurrencies, helping traders understand market behavior and identify market trends. In this article, we will delve into the top technical analysis strategies for successful cryptocurrency trading in today’s market. We will also discuss the psychology of trading and how traders can use fundamental analysis to make informed trading decisions. Lastly, we will explore the latest crypto news and market trends to stay ahead of the game.

Section 1: Understanding Technical Analysis

Technical analysis is the process of using past price and volume data to identify market trends and make trading decisions. There are many technical indicators available, but some are more commonly used than others. In this section, we will explore the most widely used technical indicators in cryptocurrency trading.

Subsection 1.1: Candlestick Patterns

Candlestick patterns are a widely used technical indicator that can help traders understand market behavior. They provide a visual representation of market sentiment, allowing traders to identify trends and predict future price movements. Some common candlestick patterns include hammers, shooting stars, doji, and spinning tops.

Subsection 1.2: Support and Resistance

Support and resistance levels are another widely used technical indicator in cryptocurrency trading. Support represents the price level at which demand is strong enough to prevent the price from falling further. Resistance represents the price level at which supply is strong enough to prevent the price from rising further. Traders can use these levels to identify potential price targets and determine stop-loss levels.

Subsection 1.3: Moving Averages

Moving averages are a lagging indicator that can help traders identify trends and potential price reversals. They smooth out price fluctuations over a set period, providing a clearer picture of market behavior. Common moving averages used in cryptocurrency trading include simple moving averages, exponential moving averages, and weighted moving averages.

Subsection 1.4: Momentum Indicators

Momentum indicators are a technical indicator that can help traders identify potential trend reversals. They measure the rate at which prices are changing, providing insight into the strength of price movements. Some commonly used momentum indicators include the relative strength index (RSI) and the stochastic oscillator.

Section 2: Fundamental Analysis and its Role in Trading

Fundamental analysis is the process of using real-world events and economic data to make trading decisions. While technical analysis focuses on past price and volume data, fundamental analysis takes into account external factors that can impact the price of cryptocurrencies. These factors can include news events, regulatory developments, and the overall state of the global economy.

Section 3: The Psychology of Trading

The psychology of trading is a critical component of successful cryptocurrency trading. Traders must be able to manage their emotions and make rational decisions based on market trends and data. In this section, we will explore some of the key principles of trading psychology.

Subsection 3.1: Overcoming Fear and Greed

Fear and greed are two powerful emotions that can impact trading decisions. Fear can cause traders to panic sell during a downturn, while greed can cause traders to hold onto positions for too long, missing out on potential profits. Traders must learn to manage these emotions to make rational decisions based on market trends.

Subsection 3.2: Trading with Discipline

Discipline is a critical component of successful cryptocurrency trading. Traders must stick to their trading plan and avoid impulsive decision-making. This can include setting clear entry and exit points, maintaining stop-loss levels, and avoiding emotional trading.

Subsection 3.3: Managing Risk

Risk management is an essential aspect of cryptocurrency trading. Traders must be able to manage their risks effectively, including setting stop-loss levels, diversifying their portfolio, and avoiding over-leveraging their positions.

Section 4: Staying Ahead of the Game

Staying up to date with the latest crypto news and market trends is essential for successful trading. In this section, we will explore some of the best ways to stay ahead of the game.

Subsection 4.1: Latest Crypto News and Market Trends

Keeping up with the latest crypto news and market trends is critical for successful trading. Traders can use news events to inform their trading decisions and stay ahead of market trends.

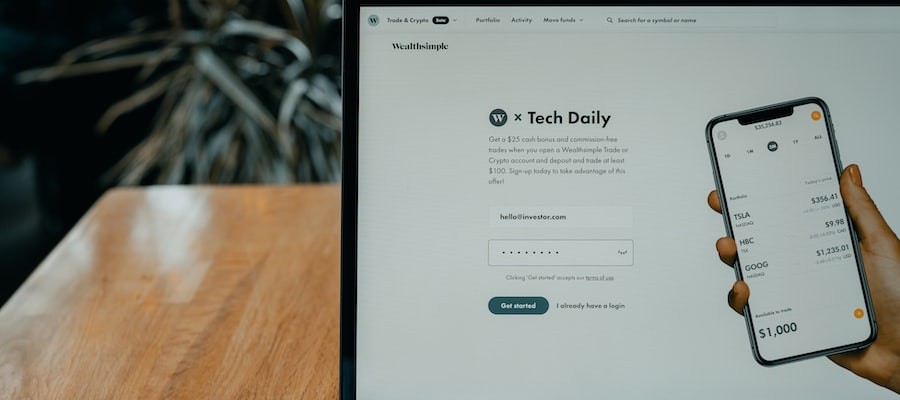

Subsection 4.2: Trading Platforms and Tools

Using the right trading platforms and tools can help traders make informed and profitable trading decisions. Some popular trading platforms and tools in the cryptocurrency space include TradingView, Coinigy, and CryptoTrader.

Conclusion

In conclusion, successful cryptocurrency trading requires a combination of technical analysis, fundamental analysis, and solid trading psychology. Traders must be able to manage their risks effectively, stay up to date with the latest news and market trends, and avoid impulsive decision-making. By following the strategies outlined in this article, traders can increase their chances of success in a highly competitive and ever-evolving market.

FAQs

Q1. How can I use moving averages in my trading?

A1. Moving averages can help traders identify trends and potential price reversals. Traders can use these indicators to determine entry and exit points, as well as stop-loss levels.

Q2. How can I stay up to date with the latest crypto news?

A2. There are many ways to stay up to date with the latest crypto news, including following industry influencers on social media, subscribing to crypto news websites and newsletters, and joining crypto communities on Reddit and Telegram.

Q3. What is the best trading platform for cryptocurrency trading?

A3. The best trading platform for cryptocurrency trading will depend on individual preferences and trading styles. Some popular platforms include Binance, Coinbase, and Kraken.

Q4. How can I manage my risks effectively in cryptocurrency trading?

A4. Traders can manage their risks effectively by setting stop-loss levels, diversifying their portfolio, avoiding over-leveraging their positions, and sticking to their trading plan.

Q5. How can I overcome fear and greed in trading?

A5. Overcoming fear and greed in trading requires self-awareness and discipline. Traders must learn to manage their emotions and make rational decisions based on market trends and data.